Introduction to SIP

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an investor contributes a fixed amount regularly (monthly, quarterly, or annually). This disciplined approach helps investors accumulate wealth over time, benefiting from rupee cost averaging and the power of compounding.

SIP is a preferred investment option for those looking to generate long-term wealth while minimizing market risks. Unlike lump-sum investments, SIP allows investors to mitigate volatility by investing in different market conditions.

How Does SIP Work?

SIP follows a step-by-step mechanism:

- Regular Contributions – A predetermined amount is deducted from your bank account at fixed intervals.

- Purchase of Mutual Fund Units – The invested amount buys mutual fund units based on the prevailing Net Asset Value (NAV).

- Rupee Cost Averaging – Investors buy more units when prices are low and fewer when prices are high, averaging the cost over time.

- Compounding Returns – Over time, returns on investments are reinvested, leading to exponential growth.

Example: If you invest ₹5,000 per month in an SIP for 10 years with an average return of 12% per annum, your corpus will be ₹11.6 lakh, while your total investment would be only ₹6 lakh. This growth is due to the power of compounding.

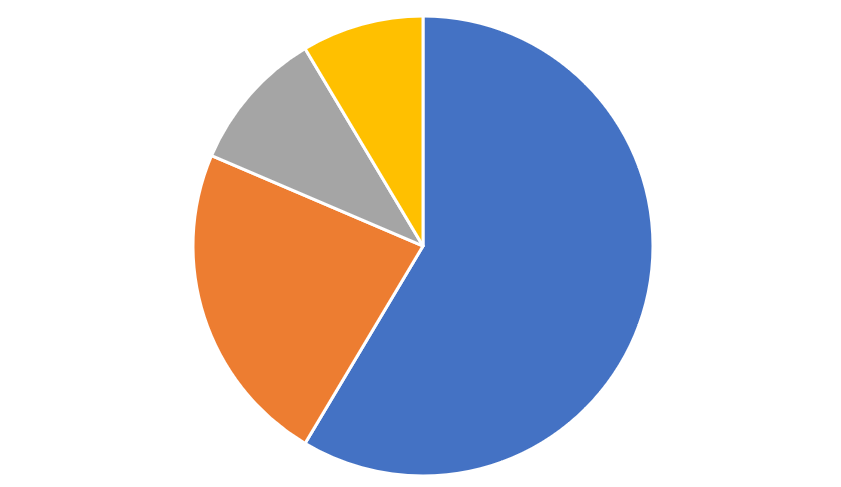

Types of SIP Investments

1. Regular SIP

- The standard SIP where a fixed amount is deducted at regular intervals.

- Suitable for investors with steady income.

2. Step-Up SIP

- Allows investors to increase the SIP amount at regular intervals.

- Ideal for salaried individuals expecting salary hikes.

3. Perpetual SIP

- Does not have a fixed tenure; investors can continue indefinitely.

- Suitable for those who want flexibility in their investment.

4. Trigger SIP

- Allows investors to set triggers based on NAV, index levels, or specific events.

- Best suited for experienced investors with market knowledge.

Benefits of Investing via SIP

1. Rupee Cost Averaging

Since SIP invests a fixed amount regularly, you purchase more units when the market is low and fewer when the market is high. This reduces the average cost per unit, mitigating market volatility.

🔹 Example: If you invest ₹5,000 in a mutual fund with a fluctuating NAV:

- Month 1: NAV = ₹50 → Units bought = 100

- Month 2: NAV = ₹40 → Units bought = 125

- Month 3: NAV = ₹45 → Units bought = 111

- Total Investment: ₹15,000, Total Units: 336, Average Cost per Unit: ₹44.64

2. Power of Compounding

Compounding helps multiply wealth by reinvesting returns. The earlier you start, the greater your returns.

Example:

- Investing ₹5,000 per month for 20 years at 12% annual returns results in a corpus of ₹50 lakh, while investing for 10 years gives only ₹11.6 lakh.

3. Financial Discipline & Convenience

- SIP automates savings and instills investment discipline.

- Hassle-free as funds are auto-debited from the bank account.

4. Affordable & Flexible

- Start investing with as little as ₹500 per month.

- Can increase, decrease, or stop SIP as per financial needs.

5. Ideal for Long-Term Wealth Creation

- Best suited for retirement planning, children’s education, home purchase, etc.

- Works well in equity funds, giving higher returns over long-term.

How to Start a SIP Investment?

Step 1: Identify Financial Goals – Define the purpose (retirement, home, education, etc.).

Step 2: Choose the Right Mutual Fund – Select funds based on risk tolerance, returns, and past performance.

Step 3: Select the SIP Amount & Tenure – Decide a comfortable investment amount and duration.

Step 4: KYC Compliance – Complete Know Your Customer (KYC) verification.

Step 5: Set Up Auto-Debit – Link SIP to your bank account for automatic deductions.

Pro Tip: Always increase SIP contributions with salary hikes to accelerate wealth accumulation.

SIP vs. Lump Sum Investment

| Feature | SIP | Lump Sum |

|---|---|---|

| Investment Method | Regular small amounts | One-time large amount |

| Market Timing Risk | Low (invests at different NAVs) | High (depends on market entry) |

| Volatility Impact | Lower due to averaging | High, subject to market swings |

| Affordability | Starts with ₹500 | Requires a large capital |

| Compounding Benefits | High over long-term | Depends on entry timing |

Verdict: SIP is a safer and more systematic approach for long-term wealth creation compared to lump sum investments, which require market timing skills.

Common Myths About SIP

❌ 1. SIP Guarantees Returns

✅ SIP reduces risks but does not guarantee fixed returns. Market performance affects mutual fund growth.

❌ 2. SIP is Only for Small Investors

✅ SIP is for all investors, whether small or large, as it builds wealth systematically.

❌ 3. SIP is Only for Equity Funds

✅ SIP works in all mutual fund categories, including debt and hybrid funds.

❌ 4. SIP Should Be Stopped in a Bear Market

✅ Bear markets provide a chance to buy more units at lower NAVs, leading to better returns in the long run.

Best Mutual Fund Categories for SIP

1. Large-Cap Funds – Invest in stable, blue-chip companies (e.g., SBI Bluechip Fund).

2. Mid-Cap & Small-Cap Funds – Higher returns with moderate risk (e.g., Nippon India Small Cap Fund).

3. Hybrid Funds – Balance of equity & debt for stability (e.g., HDFC Balanced Advantage Fund).

4. ELSS (Tax Saving Funds) – Provides tax benefits under Section 80C (e.g., Axis Long Term Equity Fund).

Who Should Invest in SIP?

Beginners – Easy entry with low investment.

Salaried Professionals – Ensures disciplined savings.

Long-Term Investors – Ideal for wealth creation & retirement planning.

Risk-Averse Investors – Reduces impact of market volatility.

Expert Tip: SIP should be continued for at least 5–10 years to reap maximum benefits.

Conclusion: Why SIP is the Best Investment Strategy?

Safe & Disciplined Approach – Encourages regular investing without market timing stress.

Long-Term Wealth Growth – Works best when invested for 5–20 years.

Flexibility & Convenience – Start, pause, or increase investments as per financial situation.

Ideal for Everyone – Suits small investors, professionals, and high-net-worth individuals alike.

🚀 Start your SIP today and build a financially secure future!